The global trade fair industry is recording record sales, leaving behind the deep trough caused by the coronavirus pandemic. Sales growth of 20 and 17 per cent is expected for 2023 and 2024 compared to the previous year. This is according to the latest edition of the Global Exhibition Barometer published by the International Association of the Exhibition Industry (UFI) at the beginning of August. The latest survey confirms the industry's turnover forecasts from the January edition and confirms an increase in jobs and investment activity.

Against a complex global backdrop, the global exhibition industry is optimistic about its short and medium-term prospects. For example, 48 per cent of companies plan to increase their workforce in the next six months, while a further 48 per cent intend to keep their current staffing levels stable. The highest proportion of companies planning to increase their workforce is to be found in Malaysia (91 per cent), Brazil (75 per cent) and the United Arab Emirates (73 per cent).

Globally, business activity increased for half of companies in the first half of 2024 (4 in 10 in Asia-Pacific, Central and South America and the Middle East and Africa; and 6 in 10 in Europe and North America), while it was classified as "normal" by one in three companies. This trend will continue in the coming year, with the average percentage of companies reporting increased activity ranging from 59 per cent in North America to 50 per cent in Asia Pacific, 49 per cent in the Middle East and Africa, and 48 per cent in Central and South America and Europe.

Sales in 2023 compared to 2022 vary from 143 per cent in Malaysia, 139 per cent in Thailand, 132 per cent in Argentina and the US to 105 per cent in Spain, 103 per cent in Brazil and 101 per cent in Australia. Sales in 2024 compared to 2023 vary from 148 per cent in Colombia, 138 per cent in Brazil, 123 per cent in the UAE, to 106 per cent in Germany, 105 per cent in China and 98 per cent in France.

In terms of operating profits for 2023, 61 per cent of companies forecast an annual increase of more than 10 per cent and 27 per cent a constant increase. For 2024, 47 per cent expect an increase of more than ten per cent and 39 per cent expect a stable increase. The highest proportion of companies expecting an annual profit increase of more than 10 per cent for 2023 are in Malaysia (100 per cent), Spain (83 per cent) and Thailand (75 per cent), as well as in Brazil (82 per cent), the United Kingdom (69 per cent) and Malaysia (58 per cent) for 2024.

When asked about the most pressing challenges, the economic situation in the home market is the most pressing issue (22 per cent), followed by 'global economic development' (15 per cent). This is followed by internal management challenges (11 per cent), sustainability/climate (nine per cent) and the impact of digitalisation (six per cent).

Current strategic priorities

In all regions, a large majority of companies intend to develop new activities, either in the traditional area of the exhibition industry, outside the current product portfolio or in both areas. In terms of geographic expansion, 43 per cent of companies say they intend to expand into new countries and regions.

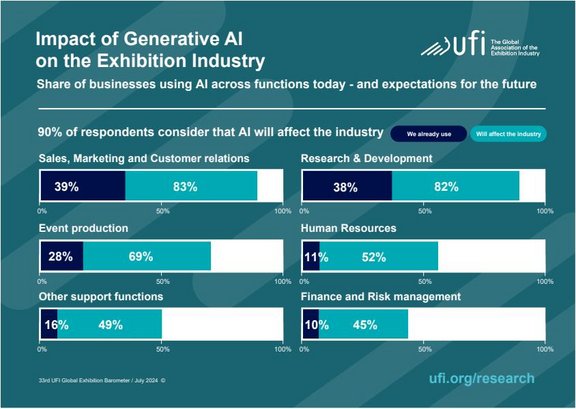

There is a general consensus that AI will impact the industry. 90 per cent of companies state this, and a growing proportion of companies report that they are actively using this new technology. The areas that will be most affected by AI developments are the same across all regions: sales, marketing and customer relations (83 per cent globally), research and development (82 per cent) and event production (69 per cent). These are precisely the areas in which generative AI applications are already most frequently used in all regions (39 per cent, 38 and 28 per cent worldwide respectively).

The study also includes forecasts and analyses for 19 focus countries and regions - Argentina, Australia, Brazil, China, Colombia, France, Germany, Greece, India, Italy, Malaysia, Mexico, Saudi Arabia, South Africa, Spain, Thailand, the United Arab Emirates, the United Kingdom and the USA - as well as for five additional aggregated regional zones.

The current edition of the biannual UFI Industry Report was finalised in July 2024 and includes data from 453 companies across 68 countries and regions. The next UFI Global Exhibition Barometer survey will be conducted in December 2024.

Further information: https://www.ufi.org/archive-research/the-global-exhibition-barometer-august-2024/